Bank Santander Polska is one of the largest and most important financial institutions in Poland. It is part of the Santander Group, a leading global financial group headquartered in Spain, with a strong presence across Europe, North and South America.

As a member of this international banking group, Santander Bank Polska benefits from global expertise, technological innovation, and a wide range of financial products and services. The bank offers services for individual customers, small and medium-sized enterprises (SMEs), and large corporations.

In Poland, Santander Bank Polska is ranked among the top three banks in terms of asset size, number of clients, and market share. It is known for its customer-friendly digital banking solutions, strong branch network, and comprehensive financial services, including personal banking, corporate banking, investment products, and insurance.

The bank is also listed on the Warsaw Stock Exchange and plays a significant role in the development of the Polish financial market.

History of Santander Bank Polska

| Category | Details |

|---|---|

| Bank Origins | Originally operated as Bank Zachodni WBK, one of Poland’s oldest private banks. |

| Merger History | Formed in 2001 through the merger of Bank Zachodni and Wielkopolski Bank Kredytowy (WBK). |

| Acquisition by Santander | In 2011, Spain’s Banco Santander acquired a majority stake in BZ WBK from Allied Irish Banks. |

| Name Change | In 2018, BZ WBK was officially renamed to Santander Bank Polska S.A. |

| Group Affiliation | A wholly owned subsidiary of the Santander Group, a global financial leader headquartered in Spain. |

| Global Presence | Santander Group operates in over 40 countries, especially strong in Europe and Latin America. |

| Polish Market Position | One of the top 3 largest banks in Poland in terms of assets and number of clients. |

| Stock Exchange Listing | Listed on the Warsaw Stock Exchange (WSE) under the ticker SPL. |

Personal Banking Offers

| Category | Details |

|---|---|

| Current Accounts | Konto Jakie Chcę – customizable fees and features; available in PLN and foreign currencies (EUR, USD, GBP); online and mobile access via Santander Internet and app. |

| Debit Cards | Mastercard and Visa debit cards with contactless and mobile payment support (BLIK, Apple Pay, Google Pay). |

| Credit Cards | Classic, Gold, Platinum, and 123 Credit Card with cashback; interest-free period up to 54 days; optional insurance. |

| Savings & Deposits | Savings accounts with flexible access; fixed-term deposits (Lokaty) with promotional interest for new funds. |

| Loans & Credit | Cash loans with fast online approval; mortgage loans with eco-discounts; debt consolidation and refinancing options. |

| Insurance Products | Life, travel, home, and loan repayment insurance; offered in partnership with Santander Aviva. |

| Digital Services | Santander mobile app and online banking with full account management, payments, and mobile transfers (BLIK). |

| Service Language | English-speaking staff available in selected branches; bilingual documents and mobile interface supported. |

Personal Loans & Credit

| Product | Loan Amount | Term | Interest Rate | APR (RRSO) | Key Features |

|---|---|---|---|---|---|

| Cash Loan (Gotówkowy) | 500 – 250,000 PLN | 3 – 120 months | 9.49% – 16.99% | from 10.24% | Online application, no commission up to 250,000 PLN, quick payout, flexible use |

| Mortgage Loan | Up to 90% property value | Up to 35 years | Fixed or variable (from ~7%) | Depends on profile | For purchase, renovation, or construction; eco-loan discounts available |

| Refinancing Loan | Based on current loan | Flexible | Often lower than current | Varies | Transfers your loan from another bank with better terms |

| Consolidation Loan | Based on existing debts | Up to 10 years | From ~11% | Varies | Combines multiple loans/credit cards into one payment |

| Overdraft Limit | Up to 5,000 PLN | Revolving | From ~14% | Based on usage | Automatically available on current account |

| Loan Insurance | Optional | Matches loan term | – | – | Covers repayment in case of illness, job loss, disability |

Business Banking Services

| Category | Details |

|---|---|

| Business Accounts | • Biznes Konto – PLN current account for sole traders and companies • Multi-currency accounts (EUR, USD, GBP) • Online & mobile access with full banking tools |

| Debit & Credit Cards | • Business debit cards with daily spending limits • Corporate credit cards with flexible repayment and expense control |

| POS Terminals | • Stationary, mobile, and online POS terminals (e.g., for shops, restaurants, couriers) • Integration with accounting tools • Contactless & e-commerce ready |

| Online & Mobile Banking | • Santander Business platform with tools for invoicing, payments, reports • Multi-user access for teams |

| Business Loans | • Working capital loans, investment loans, overdrafts • Flexible repayment, fast decision process • Special financing for start-ups and green investments |

| Leasing & Factoring | • Vehicle and equipment leasing • Invoice factoring to improve cash flow |

| Insurance | • Business property, employee, cyber risk, and liability insurance options |

| Foreign Trade Services | • Currency exchange, foreign transfers, trade finance (LC, guarantees), export support |

Business Loans – Santander Bank

| Loan Type | Loan Amount | Term | Interest Rate | Key Features |

|---|---|---|---|---|

| Working Capital Loan | From PLN 10,000 | Up to 36 months | From ~8–12% p.a. (variable) | For day-to-day operational expenses; flexible repayment; fast decision process |

| Investment Loan | From PLN 20,000 | Up to 120 months | From ~6.5% p.a. (depending on collateral and risk profile) | For business expansion, machinery, renovations, new locations |

| Overdraft (Credit Line) | Based on account turnover | 12 months (renewable) | Typically ~14–16% on used amount | Linked to business account; automatic access to funds when balance is low |

| Start-up Loan | From PLN 10,000 | Up to 60 months | From ~9.99% p.a. | For new businesses with simplified application; may require business plan |

| Eco/Green Loan | Varies | Up to 10 years | Preferential rates (from ~5%) | For environmentally friendly investments – e.g., solar, energy efficiency |

| Loan with EU Funding | Up to 80% of project cost | Varies by program | Often subsidized (0–5%) | Available under selected EU initiatives and regional programs |

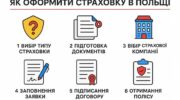

How to Open a Bank Account at Santander Bank Polska

| Step / Info | Details |

|---|---|

| Ways to Open an Account | • Online – via Santander website or mobile app (for residents with PESEL) • Offline – in any branch (recommended for foreigners) |

| Documents Required (Polish Citizens) | • National ID (dowód osobisty) |

| Documents Required (Foreigners) | • Passport • Residence permit or visa • PESEL number (if available) • Proof of address (rental agreement, utility bill, etc.) |

| Account Types Available | • Konto Jakie Chcę (PLN) • Multi-currency accounts (EUR, USD, GBP) • Student, joint, and senior accounts |

| Additional Steps | • Verification in person (offline) or via courier (online) • Sign agreement digitally or in-branch |

| Time to Open Account | • Usually same day in branch • Up to 2–3 days online with courier verification |

| Bank Card Delivery | • Sent by mail within 5–7 working days (if not issued instantly in branch) |

| Languages Available | • English-speaking staff in selected branches • App and website available in English |

Fees & Charges

| Service | Fee |

|---|---|

| Account Maintenance | PLN 0/month – if you make at least one transaction & receive PLN 500/month; otherwise PLN 6 |

| Debit Card Fee | PLN 0/month – if you pay at least PLN 300/month with the card; otherwise PLN 8 |

| ATM Withdrawals – Santander ATMs | Free |

| ATM Withdrawals – Other Banks (PL) | PLN 5 per transaction (or free with optional ATM package – PLN 7/month) |

| Domestic Transfers (PLN) | Online/mobile transfer: PLN 0 Branch transfer: PLN 10 |

| International Transfers (SEPA) | PLN 8 online PLN 30 in branch |

| SWIFT Transfers (outside EU) | From PLN 20–100 depending on amount and delivery type |

| Card Replacement | PLN 15 |

| Overdraft Interest | ~14–17% annually |

| Account Closure | Free of charge |